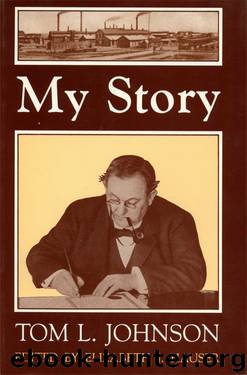

My Story by Elizabeth J. Hauser

Author:Elizabeth J. Hauser

Language: eng

Format: epub

Publisher: Kent State University Press

XV

THE WAY OUT

WHILE our State fight against the railroads was in progress the Cleveland local tax-board or board of equalization as it was generally called, composed of my appointees, was enjoined by the court of common pleas, July 22, 1901, from increasing the returns of the personal property of public service corporations in Cleveland. We fought the injunction and it was dissolved July 30. On the same day the board added nearly twenty million dollars to the tax duplicates of the street railway, the gas and electric lighting companies!

These corporations appealed to the board of revision to prohibit the increased valuation. The appeal was made in November, 1901, and on January 4, 1902, the board of revision sustained the increase.

Three days later the case was appealed to the Republican State board of tax remission, the petition claiming among other things lack of power on the part of local boards to impose the additional assessment in question. This power had never been questioned when it was exerted in extorting additional taxes from the uninformed and helpless — but here was a different case.

On February 1, the State board of tax remission composed of the State treasurer, the State auditor and the attorney general remitted the entire increase.

“I suppose you will want to know why we did this,” said Attorney-General Sheets to the newspaper men. “We based our decision on the fact that the Cleveland board applied the principles of the Nichols law to determining the value of the property of these corporations. (This law was enacted to apply to the property of express, telegraph, and telephone companies in Ohio. It provided that for tax purposes their value shall be determined by the selling value of their stocks and bonds.) If the board had simply made an error in judgment as to the value of the property we would have had no jurisdiction.”

“In other words,” said the Cleveland Plain Dealer, commenting on it, “if the Cleveland board had gone out and looked at the physical property of the corporations concerned and then guessed at its value, this board could not have remitted a cent, though the guess had been that a total of twenty million dollars should be added. It was because the board based its action, according to the Nichols law, on the market value of the stocks and bonds of these concerns that the State board overruled it.”

Continuing, the Plain Dealer said: “The fact that the value of the stocks and bonds was confirmed by the Cleveland board by a careful appraisement of the physical property and the cost of reproduction in each case was not sufficient departure from the fixed rule laid down in the Nichols law to suit said board. That law was enacted to apply to the property of express, telegraph, and telephone companies in Ohio. It provided that for tax purposes their value shall be determined by the selling value of their stocks and bonds.”

Of course, a decision against the public service corporations would have meant

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

Waking Up in Heaven: A True Story of Brokenness, Heaven, and Life Again by McVea Crystal & Tresniowski Alex(37633)

Still Foolin’ ’Em by Billy Crystal(36232)

Cecilia; Or, Memoirs of an Heiress — Volume 1 by Fanny Burney(32396)

Cecilia; Or, Memoirs of an Heiress — Volume 3 by Fanny Burney(31778)

Cecilia; Or, Memoirs of an Heiress — Volume 2 by Fanny Burney(31749)

Fanny Burney by Claire Harman(26503)

Empire of the Sikhs by Patwant Singh(22925)

We're Going to Need More Wine by Gabrielle Union(18926)

Hans Sturm: A Soldier's Odyssey on the Eastern Front by Gordon Williamson(18448)

Plagued by Fire by Paul Hendrickson(17310)

Out of India by Michael Foss(16769)

All the Missing Girls by Megan Miranda(15445)

Cat's cradle by Kurt Vonnegut(15127)

Pimp by Iceberg Slim(14262)

Molly's Game by Molly Bloom(14039)

Bombshells: Glamour Girls of a Lifetime by Sullivan Steve(13941)

Leonardo da Vinci by Walter Isaacson(13128)

For the Love of Europe by Rick Steves(12449)

4 3 2 1: A Novel by Paul Auster(12245)