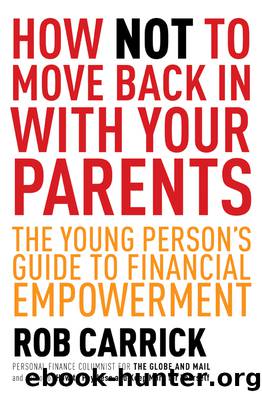

How Not to Move Back in With Your Parents by Rob Carrick

Author:Rob Carrick

Language: eng

Format: epub

Publisher: PRH Canada Young Readers

Published: 2012-03-27T04:00:00+00:00

WHAT ABOUT YOUR PARENTS’ RETIREMENT SAVINGS?

Wait a second, aren’t we talking here about how twenty- and thirtysomethings can prepare for retirement? Yes, and to be thorough we have to look at all eventualities. One of them is that your parents may not have sufficient retirement savings and thus have to rely on you to help them out in their senior years.

There are a few different ways parents can end up depending on their kids. It could be with some cash to cover a sudden expenditure—maybe a new roof for the house or a major car repair. It could be a loan to tide them over until the sale of the family home is complete. Or the parental assistance could take the form of medical costs—say, twenty-four-hour in-home nursing care.

If they find they are financially struggling after they retire, your parents shouldn’t hesitate to ask you for help if they need it. That’s what families do for each other. But if your parents value their financial independence, it couldn’t hurt for you to check in with them early about how their retirement savings plan is coming along. The good news for your parents is that they probably still have some years to go before they retire, and that means there’s at least a little time to address any shortcomings. In fact, the years after their kids move out can be a prime retirement savings period for parents.

Here’s a low-stress way to get a conversation going with your parents about their retirement saving. Tell them that you’ve recently been getting your own RRSP going and you want to exchange ideas. During the conversation, ask your parents how confident they are about a financially comfortable retirement. It’s a bad sign if they have no idea of how much they have or will need in retirement, or if they evade the topic as if it’s painful to talk about.

If your parents have a financial adviser, they should have a retirement plan in place. Are they sketchy on the details? Then they should schedule a meeting and ask how much they’re on track to have saved by retirement, and what kind of lifestyle that amount is likely to finance. If there’s a shortfall, they can plan to work longer or contribute more to their RRSPs.

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

The Rise and Fall of Senator Joe McCarthy by James Cross Giblin(5266)

Paper Towns by Green John(5174)

The Giant and How He Humbugged America by Jim Murphy(3429)

The Science Book (Big Ideas Simply Explained) by DK(3274)

Eleanor & Park by Rainbow Rowell(3147)

The President Has Been Shot!": The Assassination of John F. Kennedy by Swanson James L(3086)

The Rape Of Nanking by Iris Chang(2806)

Merriam-Webster's Collegiate Thesaurus, Second Edition by Merriam-Webster Inc(2747)

Harry Potter and the Deathly Hallows (7) by J.K. Rowling(2706)

Ancient Worlds by Michael Scott(2675)

Beautiful Oblivion by Jamie McGuire(2599)

Eligible by Curtis Sittenfeld(2579)

Dork Diaries 12 by Rachel Renée Russell(2358)

Sharp Objects by Gillian Flynn(2286)

The Unlikely Pilgrimage of Harold Fry by Rachel Joyce(2262)

Frankly, Frannie by AJ Stern(2201)

The Astronomy Book by DK(2151)

Forensics by Val McDermid(2087)

Who Was Louis Braille? by Margaret Frith(1970)