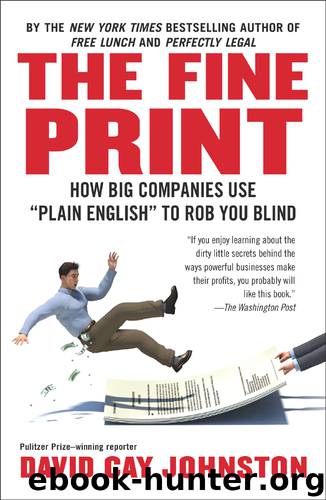

The Fine Print by David Cay Johnston

Author:David Cay Johnston [Johnston, David Cay]

Language: eng

Format: epub

ISBN: 9781101476307

Publisher: Penguin Group US

Published: 2012-09-17T16:00:00+00:00

Banks need, of course, to collect enough from customers to justify staying in business and earn a profit. In the long run, only healthy banks can supply the rivers of cash that keep an economy flowing and growing. The historic rule about how much banks needed to service the economy was 3-3-3—borrow at 3 percent, lend at 3 percentage points above that and hit the golf course by 3 p.m. A bank that can borrow at 3 percent and lend at 6 percent should be profitable as long as it makes sound loans that customers pay back. Of course with the rise of credit-card lending in the last half century, the bigger banks got hooked on fatter margins, borrowing at, say, 5 percent and then lending at 14 percent, a margin of 9 percent, or three times the traditional spread between interest out and interest in.

Most banks do not get that spread, however. That is because each month they bundle all of their credit-card accounts and sell them to Wall Street, which gets the 9 percent spread. And unlike banks, the Wall Street system is part of a growing shadow banking system that is unregulated and largely obscured from oversight. Transparency is always the friend of markets and consumers, opaque practices the secret ally of price gougers, monopolists and thieves.

Bankers have learned that they can slap on fees, especially fees that were big enough to be lucrative, but not so big that customers would go through the complexities of closing their accounts and moving to another bank. Moving to a new bank is much harder in 2012 than a decade or two earlier. The task is made more difficult with the spread of electronic bill-paying services in which the consumer must keypunch every account name, number and address into her personal computer if she switches banks. And since most banks charge the same, or nearly the same fees, what gain is there in switching? The consumer shrugs and says, The next bank will just gouge me, too. The result has been a climate in which there is little incentive for lowering fees, so fees tend to rise in unison. And that, as shown earlier, is another sign of oligopoly instead of competition.

Other fees abound. Many banks charge a fee for using a competing bank’s automated teller machine, a device that, when introduced, consumers were told would lower their cost of having a checking account. There are charges for using paper checks and getting copies of checks, as well as annual credit-card fees.

The biggest pile of gold comes from fees for overdrawing an account. Charge a $5 item when your account has $4.99 and the overdraft fee can easily be $40. Some banks no longer let customers use their savings account to cover overdrafts, but instead require the use of a credit line. M&T Bank, a Warren Buffett bank, charges customers $10 even if they go online and move money in advance of a shortfall from their overdraft account to their checking account.

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

The Social Psychology of Inequality by Unknown(3031)

The Plant Paradox by Dr. Steven R. Gundry M.D(2621)

The Writing on the Wall by Anselm Jappe(2047)

Working for Yourself by J.D. (Nolo) Stephen Fishman(1873)

Get What's Yours for Medicare by Philip Moeller(1743)

Every Landlord's Legal Guide by Janet Portman & Stewart Marcia & Ralph Warner(1676)

The First 20 Hours: How to Learn Anything ... Fast by Kaufman Josh(1668)

ADHD on Trial by Michael Gordon(1579)

Decisive by Chip Heath(1570)

Working for Yourself by Stephen Fishman J.D. (Nolo)(1531)

Drafting Contracts: How and Why Lawyers Do What They Do, Second Edition by Stark Tina L(1499)

A Practical Guide to International Arbitration in London by Hilary Heilbron(1441)

The Lord of the Rings: The Fellowship of the Ring, the Two Towers, the Return of the King by J. R. R. Tolkien(1440)

Restitution by Restitution(1429)

The Economist Aug 8th 2015 by The Economist(1428)

Intellectual Property Strategy by John Palfrey(1426)

The Economist Aug 29th 2015 by The Economist(1392)

Collusion by Luke Harding(1325)

Persuasion by Owner(1300)